USAA Filing Options

SERVICES

UX Writing, Content Design

THE GOAL

Boost containment for members and reduce misfiling caused by the clarity of our copy.

THE STRATEGY

Collaborate with cross-functional partners on solutions. I worked with an SME and LRC partners to update the flow, and collaborated with our UX design team.

OUTCOMES

Containment. New content led to a 15% increase in containment and a 23% decrease in misfilings in DFNOL around this experience over three months.

Digital First Notice of Loss is our most-used insurance support product. But, should you file and how do you know? I workedto improve that experience with three cards.

Defining the problem

There are three things you can do when reporting a claim. My task was to revise the cards at the end of the flow to make these options clearer to members.

Most people get the idea of filing a claim, but you can also just make a report and you can often file with the other carrier against their policyholder. It’s confusing to anyone outside of P&C insurance.

File with USAA - Before

This is the least confusing of the three cards. But, there’s still a mismanagement of information here. Why do I need to know I might get my deductible back? It’s more important to know I have to pay it at all. Why is the USAA partner shop mentioned first?

Note: There’s title casing on the CTA. That’s bad. I do not like it. But, because our cards for our flows are IT hard-coded, there was no budget to change the all CTA across the experience. This is slated for Q4 2025.

File with USAA - After

I put the emphasis here on who is handling your claim. We’re your insurance company. Most people would rather trust their carrier to solve things quickly than wait and hope the other carrier will be a-okay.

I took out the slim hope that your deductible could maybe come back to you, because it doesn’t change that you will pay it now and doesn’t help me make a decision.

Overall, the fat is trimmed. There is nothing here you don’t need and the card is less cluttered.

I’d still really like to sentence case the CTA. Le sigh.

Notify USAA - Before

No one in all of America wants to pay for the damages on their own. I think I speak on behalf of the world even.

I’m normally a huge fan of less text, but the first bullet is two things, so it should be split.

In the second bullet, the ownership of the car is more important than the idea of whether you’d like it repaired.

Notify USAA - After

This is a less common option, which begs the question, why do it? So, I answer that question from the outset without making the members dig through the bullets to figure it out.

I’m really happy with the third bullet; emphasizing the ownership of the car helps member know they can’t just not repair it. Legal was happy with that solution and clarity as well.

The UX designer and I also recommended not presenting this card to members who are clearly at fault based on how they answer certain scenario questions earlier in the flow.

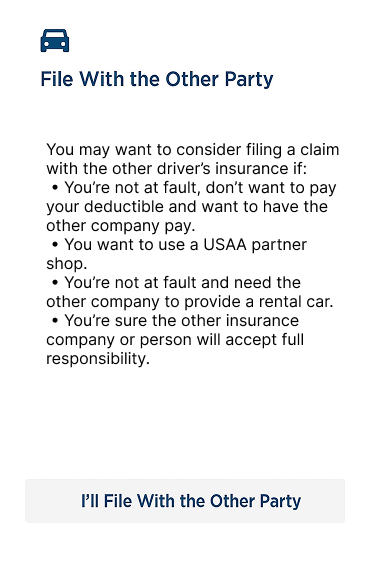

File with the other insurer - Before

This one was tricky. If I did not work in insurance, I wouldn’t know that I could file with another insurance company. You, reviewing this portfolio, likely didn’t know that if someone with Farmer’s T-bones you because he’s looking for Nickelback on Spotify, you can file with Farmers and not pay your deductible.

The goal here is to explain that, but also explain that it takes longer and is contingent on the other party accepting responsibility.

Again, no one wants to pay their deductible.

Also, is the “other party” the other carrier or Greg, the Nickelback fan? Greg counts as another “party” in an insurance claim.

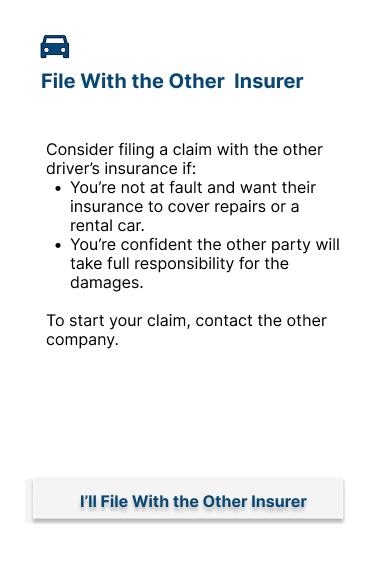

File with the other insurer - After

Aside from all the concerns above, which are now far clearer, I wanted to emphasize that clicking the CTA does not file your claim with Geico.

All the other CTA begin with action verbs. In this case, I use the subject to let the member know that when this experience closes, they have more steps to take. I explain the next step in the sentence leading up to the CTA, which was not present in the previous version.