USAA auto claims nonpolicyholder page revamp

SERVICES

UX Writing, Content Strategy

THE GOAL

Update content to fit the new design language system and CMS, or Content Management System, components we’re migrating to provide concise information and reduce call volume.

THE STRATEGY

Collaborate with cross-functional partners on solutions. I gathered business requirements, developed task flows, and created content.

OUTCOMES

Call reduction. We updated content to be consistent with our experiences but directed to a nonmember audience. This contributed to a 34% reduction in nonmember calls that year.

Nonpolicyholder claims

USAA has many products, with individual teams each creating their digital experiences in silos. This led to a disjointed user experience, akin to a ‘Frankensite.’ My team’s task was to update our page for nonpolicyholder claims to match the style of the new design system and content management systems. When doing research for this task and building task flows, our research revealed:

We’re the only major carrier handling nonpolicyholder on a separate page.

People don’t navigate to the page easily.

There is a separate FAQ that’s hard to find.

Our team put a plan together to:

Release the updated page.

Consolidate the FAQ into one section.

Develop long-form content to clarify the nonmember processes.

Phase out the nonpolicyholder page.

My meetings with subject matter experts helped identify key concepts to highlight:

What a “nonpolicyholder claim” is

What information claimants need to file

How repair shops can get updates without calling

How to file and check the status of a nonpolicyholder claim.

Nonpolicyholder page redesign

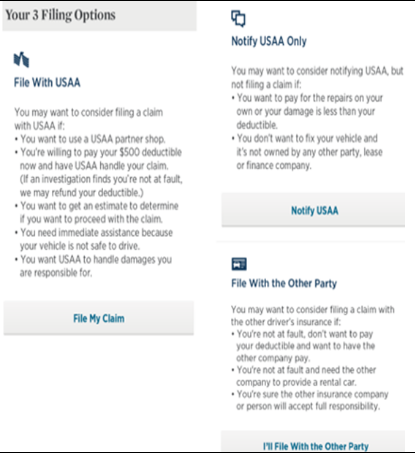

The redesigned page has new CMS components that are zoned to clearly communicate what our nonpolicyholder services offer, who should use them and when.

They focus on what is covered, which is a different user need than would apply to our members who already know what their policies cover. The page transitions into process steps and includes calls to action, (CTA) for filing or checking a claim.

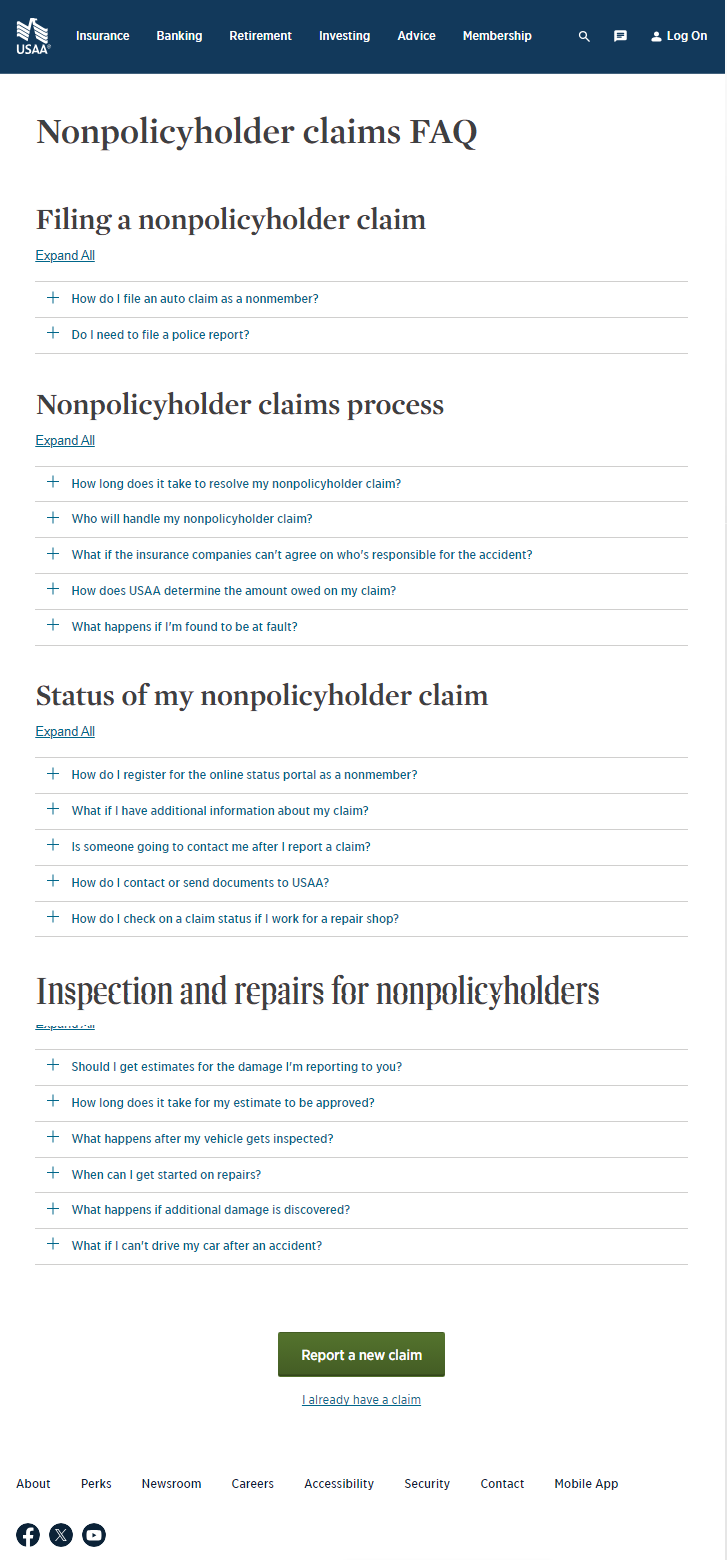

The FAQ sections for nonpolicyholders are now on one page and the headers are clearly labeled, preventing users from navigating to incorrect sections.

Notes:

While the term “nonpolicyholder” is USAA specific jargon, there isn’t really a layman term for when a claimant files a claims against another driver. Our research revealed that many people are unaware they can file with the other driver’s insurance let alone what it’s called. Most people would search using more conversational terms or discover the idea that they can file with another company when going through their own company’s flow.

The closest a competitor comes is Allstate and Progressive, who have created Answer and Tool Tip pages to explain the concept, which they call “third-party claims” to their customers. So, I added “What is a nonpolicyholder claim?” to our Nonpolicyholder FAQ to allow our jargon to be a searchable. A large part of the work was aligning the app content about filing options and making sure the FAQ had all the answers claimants didn’t find on the Nonpolicyholder support page.

As part of our CMS migration, we’ve decided to switch over to “third-party claim’ to improve SEO and align with common terminology.